In a recent blog, we highlighted some benefits of automating secondary claims processing through a clearinghouse. The ROI is potentially huge.

In a recent blog, we highlighted some benefits of automating secondary claims processing through a clearinghouse. The ROI is potentially huge.

Traditionally billers completed paper forms and mailed them to the payer. Sounds simple, but it wasn’t and, some providers are still submitting claims in this way. Phone calls and error-generated resubmittals contribute to a complex, cumbersome, costly, and prolonged payment process. With electronic claims preparation and submittal, providers can securely submit and track claims to multiple payers all in one portal. Here are some of the advantages a claims clearinghouse can offer:

- Single location electronic claims management with real-time electronic claims verifications

- Smooth claims flow to payers with a significantly reduced risk of rejections - since claims clearinghouses are connected to multiple payers and understand the peculiar format and workflow requirements

- Electronic Remittance Advice (ERA) –view all payments and adjustments

- Claim Status Reports

- Rejection analysis in which the system explains error codes in English

- Edit and correct claims online anytime

- Real-time support

ROI - Secondary claims process saves time

Think of time savings in two ways:

- Billers’ time – The manual workflow of copying, mailing, and filing claims takes time. Even hand keying claims to each payer takes time. Billers have to know the specific submission requirements of each payer. In a manually-generated claims environment, such complexities can result in errors and slower claims turnaround. With a clearinghouse, such as primeCLAIMS, the system prepares the secondary claims automatically. All billers have to do is review the claims in the Secondary tab and click on the button to send them. It’s simple. And our customers love using it. The ROI? A reduction in claims processing and related costs.

- Claims turnaround time - Office Managers can go right to the Secondary payer tab once they have downloaded the 835 ERAs (Electronic Remittance Advices). The secondary claims are there for review and submission. No delays. And the claims are accurate and prepared automatically to meet payer-specific requirements the first time. The ROI? A reduction of 4-6 weeks in claims turnaround and payment. One of our customers has stated that it has had a major impact on the reduction of Days Sales Outstanding (DSO).

To give you an idea of what’s at risk, if you are not using a clearinghouse to submit secondary payer claims, take a look at our Secondary Claims ROI calculator and see for yourself. The calculator helps you to identify what revenue may be at risk as well as the time and money it takes to manually generate the claims.

Are you collecting all your secondary claims and how much does it cost to do so?

/Prime-Care-Technologies-Logo.png?width=191&height=55&name=Prime-Care-Technologies-Logo.png)

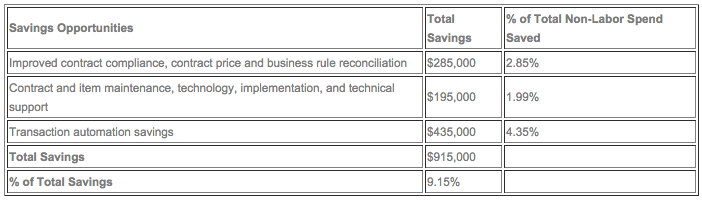

What is the ROI? Last time, I highlighted some of the features of the fully-automated procurement process. As attractive as the various features sound, the real synergy occurs when Buyers experience real savings. In today’s sluggish economy, in general, and because of dramatically contracting reimbursements for health care providers, specifically, ROI must be real and attainable.

What is the ROI? Last time, I highlighted some of the features of the fully-automated procurement process. As attractive as the various features sound, the real synergy occurs when Buyers experience real savings. In today’s sluggish economy, in general, and because of dramatically contracting reimbursements for health care providers, specifically, ROI must be real and attainable.

In past blogs I’ve referred to Patronizing Partnership as the highest level of eProcurement Evolution, a Buyer/Vendor relationship marked by trust, cooperation, and mutual support. Let’s discuss this in more practical terms which go beyond the platitudes and attitudes, first by defining what is eProcurement Evolution, specifically, complete procurement automation. (In Part II, I’ll illustrate the benefits of eProcurement with a plausible ROI scenario.)

In past blogs I’ve referred to Patronizing Partnership as the highest level of eProcurement Evolution, a Buyer/Vendor relationship marked by trust, cooperation, and mutual support. Let’s discuss this in more practical terms which go beyond the platitudes and attitudes, first by defining what is eProcurement Evolution, specifically, complete procurement automation. (In Part II, I’ll illustrate the benefits of eProcurement with a plausible ROI scenario.)