Fast Pay on All Types

Commercial claims paid as fast as 14 days

Manage claims transmission, status, and edits; or update related patient data without leaving the PointClickCare application. Benefit from real-time, two-way data exchange not currently available through other claims apps.

With all payers and each of their enrollment processes built in to primeCLAIMS, enrollments are virtually painless.

With eligibility checking across all payers, coverage is easily verified upfront. When it's time for claims submission, primeCLAIMS catches nearly 100% of errors, while offering fast editing functionality to quickly adjust any flagged errors.

Once claims are submitted, your team can log in daily to see updates and work the lists that require attention. Our EzDDE interface offers instant submission, status, and editing -- without leaving our app.

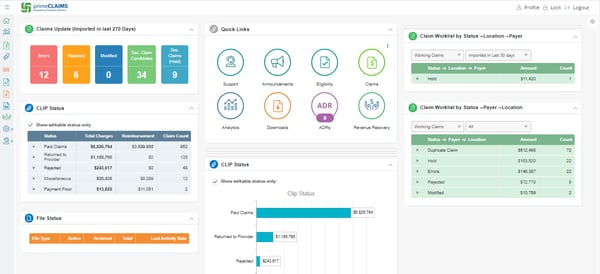

primeCLAIMS DASHBOARD

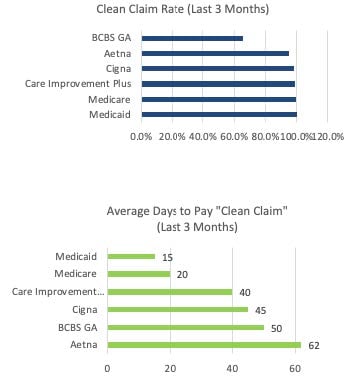

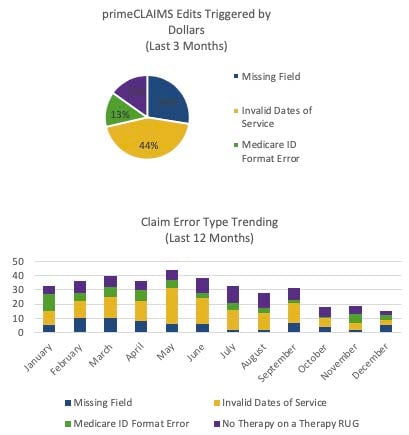

Unlimited reports offer everything you need to analyze trends and focus attention on the areas most in need.

primeCLAIMS Actionable Analytics

Clients truly can't say enough about our claims support team and are pleased with fast responses and issue resolution with tenured senior care billing experts.

"The primeCLAIMS support team—accessible by phone or email—was faster in addressing questions/issues"

– Wyndridge Health

"Training was simple, resulting in a significant reduction in the transition to full productivity."

– AR Manager & Clinical Billing Specialist, Southern Healthcare

Commercial claims paid as fast as 14 days

Nearly 100% errors found pre-submission

Claims turn time shortened by up to 50%

Fewer days sales outstanding (DSO)

We previously used a clumsy system that catered to hospitals. It didn't give us the attention we needed when encountering problems and responses were not timely.

/SHCM.jpg)

Everything promised was achieved, allowing us to focus time elsewhere.

/wyndridge-health-rehab.png)

"Not every software vendor takes the time to hear the customer and what they need. The primeCLAIMS team is flexible, open to discussion, and let customers help drive product."

In addition to a claims clearinghouse and editor for skilled nursing facilities (SNFs), primeCLAIMS offers a comprehensive dashboard to track exactly where your reimbursement revenue stands. Putting this vital status data on the home screen helps managers monitor staff progress (or hang-ups) in the SNF claims revenue cycle, including secondary claims. The software also has a module to support SNF denial management, allowing end-to-end claims monitoring from a single system.

The primeCLAIMS dashboard provides a quick look at the status of all your SNF revenue claims that have not been completed, including secondary claims. It provides a summary of Medicare claims with information on claims that still need to be modified or denied.

primeCLAIMS was built specifically for SNFs and post-acute facilities.

Each person on the Support Team has more than 20 years of experience working with and in SNF revenue cycle management. They understand the daily process of preparing, submitting, and working claims from real experience.

You can add an unlimited number of users.

The Medicare Fee-for-Service Skilled Nursing Facility (SNF) claim file contains information from paid bills submitted by SNF institutional facility providers. Skilled nursing care is the only level of nursing care that is covered by the Medicare program.

The SNF Prospective Payment System (PPS) pays for all SNF Part A inpatient services. Part A payment is primarily based on the Resource Utilization Group (RUG) assigned to the beneficiary following required Minimum Data Set (MDS) 3.0 assessments.

As a secondary payer, Medicare pays the lowest of the following amounts: (1) Excess of actual charge minus the primary payment: $175−120 = $55. (2) Amount Medicare would pay if the services were not covered by a primary payer: 80 × $125 = $100.

No, users can be set up in this application using role-based security. Users can be set up to view on a need-to-know basis including the SNF Denial Management tool.

The revenue cycle is the series of processes around health care payments, from the time a patient makes an appointment to the time a service provider is paid-- and everything in between. One way to think of it remains in terms of the life cycle of medical costs.

SNFs are repaid by Medicare Part A (healthcare facility or inpatient) or Medicare Part B (medical or outpatient), depending upon the status of the patient. The more knowledgeable services a patient requires, the greater the RUG, and the greater the reimbursement to the facility for inpatient services.

With revenue cycle management or RCM, healthcare providers guarantee they're appropriately and rapidly repaid for their services. While this is definitely advantageous to the supplier, it's similarly advantageous to the client.